Key Takeaways

- Intangible asset valuation covers brand value, goodwill, IP, and digital presence, often driving 60–80% of modern business worth.

- The three main valuation methods are Cost, Market, and Income approaches, each suited to different asset types.

- Common valuation mistakes include overestimating goodwill and ignoring licensing or amortisation.

- Malaysian valuation firms use MFRS 138 and IVS-compliant frameworks, often blending quantitative and qualitative analysis.

- Buyers pay premiums for strong digital brands, loyal customer databases, and scalable technology assets with verified performance data.

Table of Contents

ToggleIntangible assets are the unseen elements that make a business truly valuable. Things like brand reputation, software, and intellectual property. In 2025, companies with strong digital assets, such as active websites or unique tech, often earn higher valuations than those relying only on physical items like equipment or inventory.

Why Intangible Asset Valuation Matters When Selling a Business

Buyers increasingly pay for what they cannot touch, the reputation, reach, and systems that drive future profit.

If you undervalue or skip intangible valuation, you risk underselling your company’s real worth. In Malaysia, valuation accuracy affects:

- Tax reporting and SST implications

- Mergers and Acquisitions (M&A) negotiations

- Loan security assessments

- Audit compliance under MFRS 138 (Intangible Assets)

What Are the Three Main Methods of Intangible Asset Valuation?

Below is a simplified comparison of the three recognised valuation approaches under international and Malaysian standards.

Valuation Method | Best For | Core Principle | Pros | Cons |

Cost Approach | Software, R&D, internal systems | Values asset based on cost to recreate or replace | Simple to calculate, suitable for proprietary tech | Ignores market demand or profitability |

Market Approach | Trademarks, licenses, digital assets | Compares with similar market transactions | Reflects real market value | Data may be limited in niche sectors |

Income Approach | Patents, brands, customer lists | Values based on future cash flow generated | Most realistic for profit-generating intangibles | Requires forecasting and expert modelling |

How Do Valuation Experts Choose the Right Method?

Professionals often combine two or more methods to validate their results and adjust for market volatility.

For example:

- A SaaS firm may use income approach for recurring subscriptions, plus cost approach to measure proprietary algorithm value.

- A franchise brand may combine market comparables (based on other franchises sold) with income projections from royalties.

In Malaysia, certified valuers under Board of Valuers, Appraisers, Estate Agents and Property Managers (BOVAEP) or members of Malaysian Institute of Accountants (MIA) usually follow International Valuation Standards (IVS) when preparing reports for mergers or equity transactions.

Common Mistakes When Valuing Intangible Assets

Even seasoned owners can miscalculate when intangible-heavy businesses are involved. Here are the most frequent errors:

1. Overestimating Goodwill

Goodwill is not brand reputation alone, it’s the residual value after deducting identifiable assets from total purchase price. Inflated goodwill creates unrealistic buyer expectations and post-sale disputes.

2. Ignoring Licensing, Royalties, and Expiry Dates

Software and trademark licenses often have limited terms. Forgetting to account for remaining contract life can dramatically affect valuation accuracy.

3. Treating Intangibles as Static

A brand’s digital presence can rise or fall quickly. Always update web analytics, domain authority, or customer engagement data before valuation.

4. Neglecting Amortisation

Intangible assets depreciate differently from tangible assets. MFRS 138 requires systematic amortisation based on useful life, unless the asset has indefinite life (such as goodwill).

5. Using One Method for All

Not all intangibles behave the same way. As an example, patents generate revenue differently than customer loyalty programs.

“Valuation is part art, part science. Numbers alone don’t capture what makes a brand or technology valuable in the marketplace.”

How Buyers Evaluate Intangible-Heavy Businesses

Buyers look beyond your balance sheet, they assess how transferable, defensible, and monetisable your intangibles are.

Here’s what most strategic or private equity buyers review:

Buyer Focus | What They Evaluate | Impact on Valuation |

Brand Equity | Market trust, customer reviews, online sentiment | Boosts goodwill multiplier |

Digital Assets | Website traffic, SEO rankings, proprietary data systems | Increases long-term revenue potential |

Customer Base | Contract retention, churn rate, repeat purchase ratio | Directly affects projected cash flow |

Intellectual Property (IP) | Patent validity, licensing agreements, renewal terms | Strengthens buyer confidence |

Team & Culture | Staff retention, skill sets, and innovation capability | Determines sustainability post-acquisition |

“Buyers pay for systems that keep earning, not just logos and trademarks.”

What Makes Malaysian Valuation Firms Unique?

Valuation firms in Malaysia follow global standards but adjust them to suit local laws, taxes, and market conditions. This makes their reports accurate, compliant, and practical for Malaysian businesses.

Leading firms such as CBRE WTW, Raine & Horne International, KGV International, and Henry Butcher use a mix of international and local frameworks such as:

- MFRS 138: Rules for recognising and amortising intangible assets

- IVS 2024 & IFRS 13: Global standards for fair value and transparency

- Securities Commission Guidelines: For listed companies and mergers (capital market transactions)

When customer databases or CRM assets are involved, PDPA compliance must be considered. Service tax may apply to certain professional, consultancy and IT services related to IP and licensing, subject to RMCD rules and updates.

By combining global methods with local realities, Malaysian valuation firms produce reports that meet investor, auditor, and bank requirements, making them trusted partners in business sales and acquisitions.

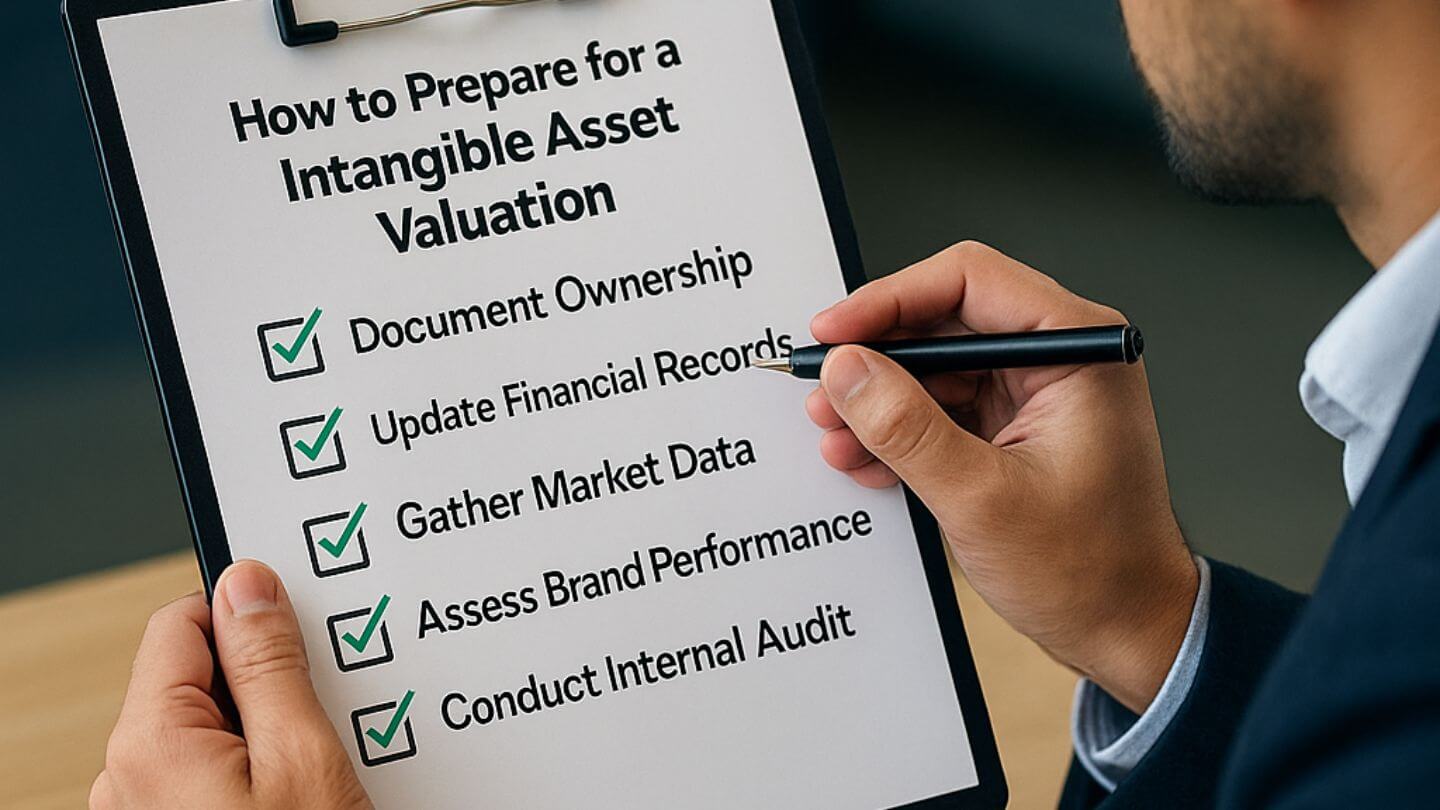

How to Prepare for an Intangible Asset Valuation

Here’s a checklist to get your business ready before engaging a valuer:

- Document Ownership Clearly

Prepare IP registrations, trademarks, and licensing agreements. - Update Financial Records

Ensure revenue streams tied to intangibles are separately traceable. - Gather Market Data

Compile industry benchmarks or competitor transaction data. - Assess Brand Performance

Include Google Analytics, SEO reports, and social media engagement metrics. - Conduct Internal Audit

Identify underused or expired digital or software assets.

How Intangible Valuation Shapes Negotiation Outcomes

A credible valuation report gives you leverage during buyer discussions.

For example:

- A company with verified proprietary tech can justify a higher EBIT multiple.

- Well-documented customer data and brand traction reduce buyer risk, which supports goodwill assessment.

- Conversely, poor or missing documentation can materially reduce perceived value and negotiating leverage.

This is also why valuation reports often accompany financial due diligence in M&A transactions.

Tip: EBIT stands for Earnings Before Interest and Taxes. It is operating profit before financing costs and income taxes.

How Technology Is Changing Valuation in 2025

AI-assisted analysis and stronger data practices are increasingly common. For business or intangible assets, valuers typically apply discounted cash flow models and sector-specific data rather than CRE-specific tools.

Valuation Data Analytics tools use predictive algorithms to forecast asset value based on:

- Customer engagement trends

- IP licensing potential

- Sentiment analysis from online brand mentions

“By 2025, data-driven valuation will replace subjective estimation. AI tools help quantify digital goodwill more precisely.”

Still Unsure How to Value Your Business?

Understanding intangible valuation is crucial whether you’re planning a merger, equity sale, or restructuring.

If you want your valuation to stand up to negotiation and due diligence, consider working with experts who specialise in intangible-heavy businesses and digital brand assets.

Conclusion: Why Intangible Asset Valuation Defines Business Worth in 2025

In 2025, intangible assets are no longer “soft” assets, they are often your most valuable ones.

Whether it’s software, customer trust, or your online brand presence, accurate valuation determines how much buyers are truly willing to pay.A professional valuation ensures transparency, compliance, and better negotiation outcomes.

If your business is gearing up for media attention or investor interest before a sale, PRESS can assist with digital PR campaigns that boost your brand’s visibility and intangible value.

Disclaimer: This article is for informational purposes only and does not constitute financial, legal, or valuation advice. Readers should consult certified valuers or financial advisors for professional guidance tailored to their specific business circumstances.

Frequently Asked Questions About How to Value Intangible Assets

What is the most accurate method to value intangible assets?

The Income Approach is usually most accurate because it links value to future cash flow, though many professionals combine methods for validation.

Are intangible assets taxable in Malaysia?

Only if they generate income or capital gains, MFRS 138 governs their recognition, while SST applies in some IP licensing cases.

How often should businesses update intangible valuations?

Every 12–24 months, or before major financing, audit, or sale events.

What’s the difference between goodwill and brand value?

Brand value is measurable through awareness and revenue contribution, goodwill is the unidentifiable excess of purchase price over fair value.

Do banks in Malaysia accept intangible assets as collateral?

Rarely on their own, but combined with audited reports, certain IPs and trademarks may be considered.

How can digital PR enhance intangible asset value?

Strong media coverage and backlinks boost perceived credibility, domain authority, and brand awareness, factors that directly affect goodwill valuation.