Key Takeaways

- Deferred tax liabilities arise when tax expense differs from accounting profit due to timing differences.

- Common causes include depreciation, provisions, and revenue recognition.

- MFRS 112 governs recognition and measurement of deferred taxes in Malaysia.

- Managing deferred taxes ensures transparency and accurate financial reporting.

- Deferred tax liabilities reflect future obligations, not immediate tax bills.

Table of Contents

ToggleWhat Is a Deferred Tax Liability?

Deferred tax liability (DTL) represents a future tax payment your business expects to make because of temporary differences between accounting profit and taxable profit.

In other words, it appears when your business pays less tax now but more later, due to differences in how accounting and tax rules treat income or expenses.

A DTL is recorded on the balance sheet as a non-current liability, aligning with the principle that taxes will become payable in future accounting periods.

Simple formula:

Deferred Tax Liability = Temporary Difference × Applicable Tax Rate

Why Deferred Tax Matters for Malaysian Businesses

Deferred taxes bridge the gap between your accounting books (following MFRS or MPERS) and your tax computation (governed by LHDN).

Understanding deferred tax matters because it:

- Improves financial statement accuracy.

- Prevents misrepresentation of profits.

- Helps investors and auditors evaluate true performance.

- Demonstrates compliance with MFRS 112 – Income Taxes.

Common Causes of Deferred Tax Liabilities in Malaysia

Deferred tax liabilities usually arise from temporary differences, income or expenses recognised in different periods for accounting and tax purposes.

| Cause | Description | Example | Impact |

| Depreciation | Tax depreciation is faster than accounting depreciation | Accelerated capital allowance | Lowers current tax, creates future taxable income |

| Revenue Recognition | Accounting recognises income earlier than tax rules | Instalment sales, advance billings | Delays tax, creates DTL |

| Provisions | Expense recognised in books before it’s deductible | Warranty or staff bonus provisions | Deductible later, creates DTL |

| Revaluation Gains | Asset revalued upwards in accounts | Property revaluation | Deferred tax on unrealised gain |

| Leases | Finance lease assets recorded differently in tax books | IFRS 16 / MFRS 16 adjustments | Temporary difference between book and tax base |

Each of these differences reverses in later years, which is why deferred tax is temporary rather than permanent.

Deferred Tax Liability vs Deferred Tax Asset

Deferred tax can work in both directions, sometimes you owe future tax (liability), sometimes you expect future savings (asset).

| Aspect | Deferred Tax Liability | Deferred Tax Asset |

| Definition | Future taxable amount | Future deductible amount |

| Example | Accelerated depreciation | Unused tax losses carried forward |

| Effect | Increases future tax expense | Reduces future tax expense |

| Financial Statement Position | Non-current liability | Non-current asset |

| Implication | Indicates tax to be paid later | Indicates benefit to be used later |

In practice, many Malaysian SMEs may have both, the net amount (asset – liability) is presented on the balance sheet.

Recognition and Measurement under MFRS 112

Malaysian companies follow MFRS 112: Income Taxes (or Section 29 of MPERS for SMEs).

Key principles:

- Recognise deferred tax for all taxable temporary differences except those from goodwill or initial recognition of assets not affecting profit or tax.

- Measure using enacted tax rates,for many Malaysian resident companies this is 24 % (though preferential rates apply for qualifying small companies).

- Review carrying amounts each year to ensure accuracy.

MFRS 112 extract:

“Deferred tax liabilities shall be recognised for all taxable temporary differences, except to the extent that the deferred tax liability arises from the initial recognition of goodwill.”

This ensures deferred tax reflects current legislation and realistic expectations.

Example: Depreciation Timing Difference

A Malaysian company buys machinery costing RM 100,000.

- For accounting, depreciation = RM 10,000 per year (10-year life).

- For tax, assume capital allowance = RM 20,000 per year (5-year period).

- Tax rate = 24% for larger resident companies (lower rates may apply to qualifying small companies.)

Temporary difference at end of Year 1:

(RM 20,000 – RM 10,000) = RM 10,000

Deferred Tax Liability:

RM 10,000 × 24 % = RM 2,400

Journal entry:

| RM | RM | |

| Income Tax Expense | 2,400 | |

| Deferred Tax Liability | 2,400 |

In later years, the difference reverses as accounting depreciation catches up, reducing the liability gradually.

How Deferred Tax Appears in Financial Statements

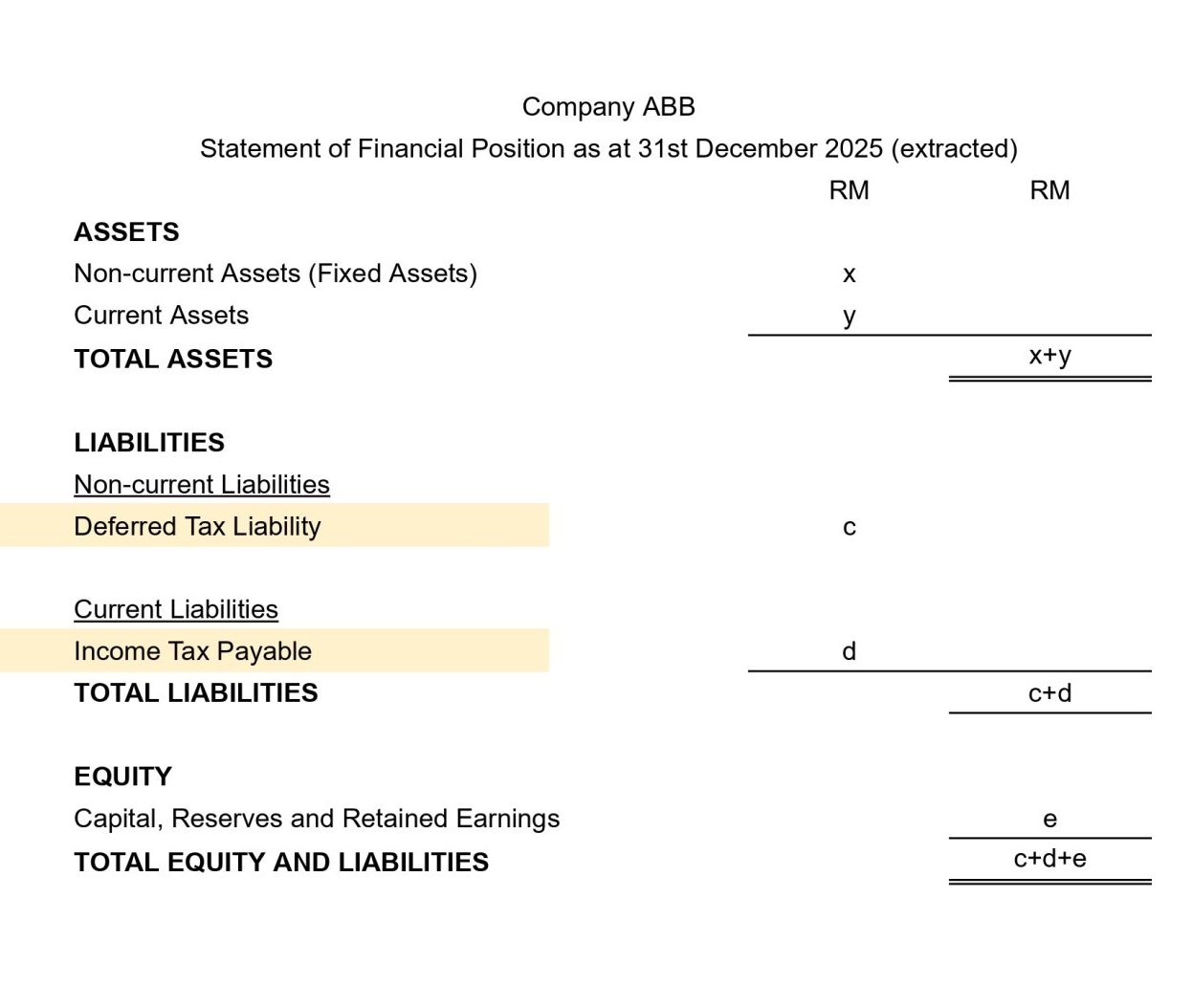

Deferred tax liabilities are shown under non-current liabilities in the statement of financial position (SOFP).

Example layout for a Malaysian SME:

Fact: The total equity and liabilities (c+d+e) should correctly balance with total assets (x+y).

In the notes to accounts, businesses must disclose:

- Major components of deferred tax (depreciation, provisions, and so on.).

- Movements during the year.

- Tax rates applied.

Deferred Tax Reversal Example

In Year 2, accounting depreciation remains RM 10,000, but tax depreciation reduces from RM 20,000 to RM 10,000 difference reverses.

Journal entry:

| RM | RM | |

| Deferred Tax Liability | 2,400 | |

| Income Tax Expense | 2,400 |

This reversal shows that deferred tax liabilities are timing adjustments, not permanent debts.

Managing Deferred Taxes in Practice

- Track temporary differences

Use accounting software or spreadsheets to monitor differences by asset or account. - Review tax rates regularly

Update deferred tax computations if Malaysia revises corporate tax rates. - Disclose transparently

Ensure note disclosures reconcile deferred tax movements clearly. - Coordinate accounting and tax teams

Align fixed-asset registers and tax computations for consistency.

“Deferred tax management builds investor trust by showing that your books reflect both present and future tax impacts.”

Compliance for Malaysian Entities

- Private Limited Companies (Sdn Bhd): Must recognise deferred tax under MFRS 112.

- Micro and Small Entities: Under MPERS Section 29 (private entities), deferred tax accounting is required when material; simplified disclosures may apply for smaller entities.

- Audited Financial Statements: Auditors review deferred tax balances for reasonableness and disclosure compliance.

Conclusion: Deferred Tax Is About Timing, Not Trouble

Deferred tax liabilities are accounting reflections of when income or expenses are recognised differently for tax purposes.

When recorded accurately, they enhance credibility, compliance, and financial transparency.

At Press – digital PR agency, we believe financial transparency builds trust. Whether you’re explaining results to investors, media, or the public, knowing how deferred tax works helps you tell a clearer, more credible story about your company’s growth.

Disclaimer: This article is for educational purposes only and does not constitute accounting or tax advice. Always consult a licensed tax agent or professional accountant before making financial decisions.

Frequently Asked Questions About Deferred Liabilities

What is a deferred tax liability?

It’s a future tax obligation arising when accounting income exceeds taxable income due to timing differences.

How do you calculate deferred tax?

Multiply the temporary difference by the applicable tax rate (currently 24 % in Malaysia).

Is deferred tax payable to LHDN immediately?

No. It’s recorded for accounting purposes only and payable when the temporary difference reverses.

What is the difference between deferred tax asset and liability?

Assets represent future tax savings; liabilities represent future tax payments.

Which standard governs deferred tax in Malaysia?

MFRS 112: Income Taxes, or Section 29 under MPERS for SMEs.

Should small businesses record deferred tax?

If differences are material, yes. It ensures more accurate and transparent financial reporting.