Key Takeaways

- Bookkeeping tracks transactions; accounting interprets them for tax and strategy.

- Proper bookkeeping ensures LHDN, SSM, and SST compliance for Malaysian SMEs.

- Cloud software simplifies e-invoicing (MyInvois) and real-time reporting.

- Outsourcing saves time while ensuring audit-ready and tax-efficient records.

- Digital bookkeeping builds credibility for loans, grants, and reinvestment claims.

Table of Contents

ToggleWhat Is Bookkeeping in Accounting

Bookkeeping records your company’s financial heartbeat, every sale, expense, and payment. It provides the foundation on which accounting turns data into business insights.

Without accurate books, even the best accountant cannot produce reliable financial statements or tax filings.

Bookkeeping = data accuracy.

Accounting = data interpretation.

Together, they ensure your business is compliant, profitable, and ready for sustainable growth.

Why Bookkeeping Matters for Malaysian Businesses

In Malaysia, bookkeeping is a regulatory and strategic necessity.

Benefits include:

- Tax compliance: Accurate records make annual LHDN submissions smooth.

- Cash-flow clarity: Identify who owes you and when payments are due.

- Loan approval: Clean records strengthen credibility with banks and investors.

- Grant eligibility: Required for SME Corp, BSN, or MDEC funding verification.

Neglecting bookkeeping often leads to late filings, SST penalties, and disqualified tax deductions under Malaysia’s accounting laws.

Bookkeeping vs Accounting: What’s the Difference

Aspect | Bookkeeping | Accounting |

Purpose | Record transactions | Analyse and interpret data |

Output | Ledgers & trial balance | Financial statements & tax reports |

Tools | Spreadsheets or cloud apps | Professional accounting systems |

Goal | Accuracy | Insight & compliance |

Bookkeeping builds the data layer, accounting uses it to plan and file taxes under MPERS (Malaysian Private Entities Reporting Standard).

Understanding Malaysia’s Bookkeeping Process

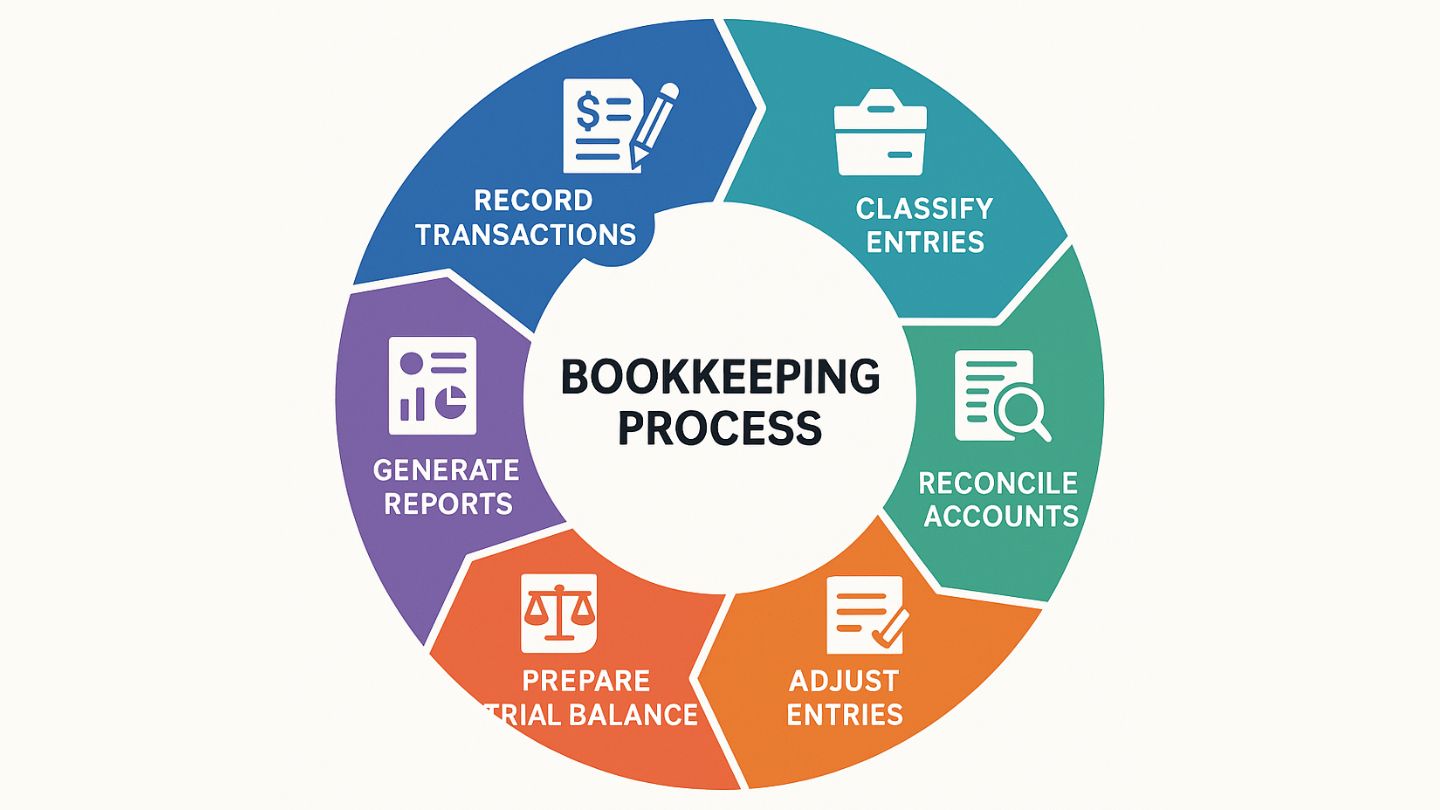

Every bookkeeping cycle follows six essential stages:

- Transaction Recording – Sales, purchases, payroll, and expenses.

- Categorisation – Sorting entries under correct accounts.

- Reconciliation – Matching ledger and bank balances.

- Adjustments – Recording accruals, prepayments, or depreciation.

- Trial Balance – Ensuring total debits equal total credits.

- Financial Reporting – Producing statements for decision-making or audits.

Modern accounting software automates these steps, reducing manual errors and ensuring compliance with Malaysian tax timelines.

Single-Entry vs Double-Entry Bookkeeping

System | Description | Recommended For |

Single-Entry | Records transactions once, simple and cash-based | Micro enterprises |

Double-Entry | Debits and credits for each transaction | SMEs and growing businesses |

Most Malaysian SMEs adopt double-entry for transparency, especially when audited under SSM or applying for grants and tax reliefs.

Why Cloud Bookkeeping Is Ideal for Malaysia’s e-Invoicing Era

Cloud systems automate compliance with LHDN’s 2026 MyInvois rollout.

Feature | Manual Bookkeeping | Cloud-Based Bookkeeping |

Data Entry | Manual spreadsheet | Automated from bank feeds |

Storage | Local | Secure cloud backup |

Reporting | Static | Real-time dashboards |

Compliance | Manual SST forms | Integrated SST & e-invoicing |

Collaboration | Limited | Multi-user access |

Adopting cloud software like Xero, SQL, or QuickBooks keeps SMEs compliant and future-ready under the government’s digitalisation agenda.

Common Bookkeeping Mistakes to Avoid

- Mixing personal and business accounts.

- Missing small cash expenses (petty cash).

- Forgetting SST classification for services.

- Inconsistent invoice numbering under MyInvois.

- Ignoring monthly reconciliations.

These issues may seem minor but cause major delays during audits or financing applications.

How Outsourced Bookkeeping Benefits SMEs

Hiring professional bookkeepers or accountants saves time and ensures compliance.

Top benefits include:

- Accuracy: Every transaction properly categorised.

- Compliance: Ready for SST and e-invoicing audits.

- Cost Efficiency: Cheaper than hiring in-house staff.

- Scalability: Add tax, payroll, or ESG reporting as needed.

“Good bookkeeping is 70 percent automation and 30 percent professional review, that mix keeps you compliant and competitive.” says a Malaysian tax consultant.

Bookkeeping and Tax Efficiency

Accurate records reduce your tax bill legally. With organised books, SMEs can easily claim:

- Reinvestment Allowance (RA) for capital upgrades.

- Automation Capital Allowance (ACA) for equipment.

- Green Investment Tax Allowance (GITA) for sustainable projects.

These incentives only apply when you can prove expenditure through invoices and ledgers. Proper bookkeeping turns tax rules into savings.

Further reading: How SMEs Can Maximise Tax Savings From the 2026 Budget

When to Hire a Professional Accountant

Consider outsourcing when you:

- Manage more than 50 monthly transactions.

- Are SST-registered or plan to be.

- Need monthly financial reports or audit prep.

- Apply for government grants or financing.

- Lack time for reconciliation and tax preparation.

A professional ensures your books align with LHDN and SSM requirements, avoiding costly penalties.

Choosing a Bookkeeping or Accounting Partner

Look for a firm that:

- Uses cloud software integrated with MyInvois.

- Understands Malaysian tax codes and SST rules.

- Offers transparent monthly pricing.

- Provides financial advice, not just data entry.

Partnering with a trusted accountant ensures your business stays compliant and financially healthy.

Conclusion: The Smart Way Forward for Malaysian SMEs

Bookkeeping is more than compliance, it’s financial clarity.

As Malaysia transitions to full e-invoicing and ESG reporting, accuracy in records defines how ready your business is for the digital economy.

That’s where PRESS Digital comes in. While accountants handle your books, PRESS helps your business communicate financial transparency, digital transformation, and brand integrity through effective PR, content strategy, and online visibility. Our campaigns are built to enhance your reputation, whether you’re promoting new services, announcing partnerships, or highlighting compliance excellence.

With PRESS Digital PR agency, your brand doesn’t just keep the books, it tells the story behind them.

Frequently Asked Questions About Bookkeeping & Accounting in Malaysia

What is bookkeeping in Malaysia?

It’s the process of recording daily transactions for financial and tax reporting under LHDN standards.

How often should I update my books?

At least once a month, weekly updates are ideal for cash-flow tracking.

Do small businesses need an accountant?

Yes, to ensure SST, e-invoicing, and tax compliance as the business scales.

Can cloud bookkeeping replace accountants?

No. Software automates tasks, but professionals ensure accuracy and compliance.

What’s the bookkeeping software available for Malaysian SMEs?

SQL, Xero, and QuickBooks integrate seamlessly with MyInvois and local tax formats.

How does bookkeeping support tax savings?

Clean records allow you to claim deductions and incentives like RA, ACA, and GITA.