Key Takeaways

- Assets are resources controlled by a business expected to generate future economic benefits.

- Assets are classified by liquidity, physical form, and function, influencing how they are recorded.

- Accurate asset recording uses double-entry accounting, starting from acquisition cost to disposal.

- Depreciation, amortisation, and impairment adjust asset values over time for accurate reporting.

- Proper asset management affects business valuation, financing, and financial decision-making.

Table of Contents

ToggleAssets are economic resources that provide value and benefit to a business.

In accounting, an asset is any resource a business owns or controls, arising from past transactions, that is expected to produce future economic benefits. This includes everything from physical items like machinery to intangible items like trademarks.

It is fundamental to a company’s balance sheet and critical for evaluating its financial health.

Why Do Assets Matter in Business?

Assets represent the foundation of a company’s financial strength, operational capacity, and future income potential.

Assets are used in daily operations to produce goods or deliver services. They support revenue generation and long-term growth. A strong asset base improves creditworthiness, investor confidence, and a company’s ability to secure financing. Financial institutions and stakeholders use asset data to evaluate a business’s solvency, liquidity, and investment potential.

How Are Assets Classified?

Assets are grouped based on time, form, and purpose for better tracking, reporting, and decision-making.

1. By Time: Current vs Non-current

Current Assets: Are expected to be realised in the normal operating cycle or within 12 months after the reporting date.

Examples: Cash, inventory, accounts receivable, prepaid expenses

Non-current Assets: Long-term resources provide value for more than 12 months, not meant for immediate sale.

Examples: Land, office buildings, long-term equipment, vehicles

2. By Nature: Tangible vs Intangible

Tangible Assets: Physical items used in daily operations like furniture, vehicles, computers, machinery, factory tools.

Intangible Assets: Non-physical but legally protected or income-generating such as intellectual property (IP), brand names, or customer relationships.

Examples: Software licenses, trademarks, patents, copyrights, goodwill

3. By Usage: Operating vs Non-operating

Operating Assets: Directly contribute to revenue and business operations.

Examples: Manufacturing equipment, sales vehicles, computers used by staff.

Non-operating Assets: Owned by the business but not essential to daily operations.

Examples: Investment property, surplus land, dormant equipment.

Classification | Examples | Key Characteristic |

Current Assets | Cash, Inventory, Receivables | Liquid within 1 year |

Fixed/Non-current | Property, plant and equipment (PPE) | Used long-term, depreciated |

Intangible Assets | Trademarks, Software | Amortised or impairment tested |

Financial Assets | Investments, Bonds | Generate financial returns |

How to Record Assets in Accounting

Proper asset recording follows the double-entry system and aligns with accounting standards at cost upon acquisition.

1. Initial Recognition

Assets are initially recorded at cost (purchase price plus costs necessary to bring the asset to its intended use, such as shipping, installation, legal fees). This follows the historical cost basis at initial recognition. Note that some assets may subsequently be measured at revalued amounts or fair value under IFRS.

Purchase equipment with cash: Debit Equipment (Asset), Credit Cash.

Purchase on credit: Debit Equipment, Credit Accounts Payable.

2. Capitalisation Criteria

- Only capitalise costs if the asset provides future economic benefit beyond one year.

- Day-to-day repairs and small-value items (such as office supplies) should be expensed, not capitalised.

3. Recording Depreciation, Amortisation & Impairment

- Depreciation: For tangible assets (vehicles, machinery), it spreads cost over useful life.

- Amortisation: For intangible assets with a defined useful life (software, licenses).

- Impairment: Recognise an impairment loss when an asset’s recoverable amount (the higher of its fair value less costs of disposal and its value-in-use) falls below its carrying amount.

There are 3 main depreciation methods businesses use:

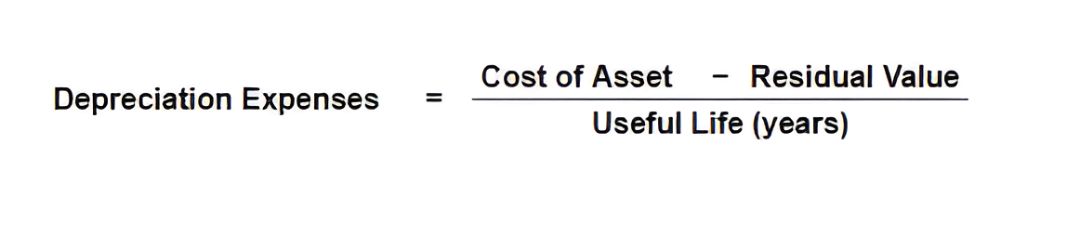

Straight-Line Method (most common & simplest)

Expense is spread evenly across the useful life.

- Cost of Asset = purchase price + costs to get it ready for use

- Residual Value = estimated value at end of useful life (scrap value)

- Useful Life = number of years the asset is expected to be used

Try yourself:

Machine cost = RM100,000

Residual value = RM10,000

Useful life = 5 years

Can you get the depreciation expenses of RM18,000 per year?

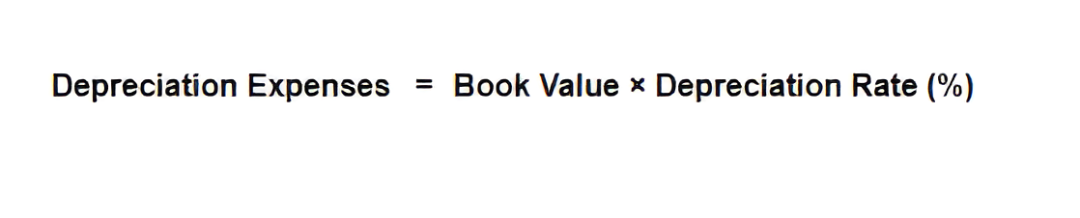

Reducing Balance / Declining Balance Method (accelerated depreciation)

Higher depreciation in early years, lower later on. This method is useful for assets that lose value quickly (such as IT equipment, vehicles).

- Book Value = value of an asset shown in the company’s balance sheet (Original Cost of Asset−Accumulated Depreciation).

Example:

Machine cost = RM100,000, depreciation rate = 40%

Year 1 depreciation expenses: 100,000 × 40% = RM40,000

Year 2: (100,000 – 40,000) × 40% = RM24,000

Year 3: (60,000 – 24,000) × 40% = RM14,400

…and so on

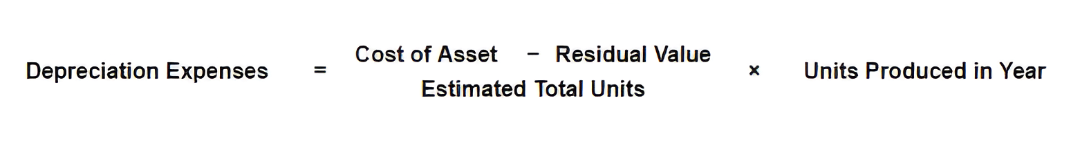

Units of Production Method

Based on how much the asset is actually used, not years. This method is best for machines, vehicles, or equipment that are tied to output.

Example:

Cost = RM100,000, Residual value = RM10,000

Total units can be produced = 50,000

Depreciation per unit: (100,000 – 10,000) ÷ 50,000 = RM1.80

If 12,000 units produced that financial year, depreciation of the year = 12,000 × 1.80 = RM21,600

4. Revaluation and Fair Value Adjustments (if applicable)

In some cases, assets can be revalued to fair market value. The adjustment depends on accounting standards under MFRS/IFRS. Any increase typically goes to a revaluation reserve and decreases may be charged to P&L.

Read more: How to Treat Revaluation Reserve in Your Accounts (Malaysia Edition)

5. Disposals and Write-offs

When an asset is sold or scrapped, remove both the asset and accumulated depreciation from books. Record any gain or loss based on the difference between sale price and book value.

Asset sold above book value

Assumptions: Equipment cost RM50,000.

Accumulated depreciation up to date is RM30,000.

From the above information, you can get book value (Net) = RM20,000.

Equipment sold for RM25,000 (gain of RM5,000).

Workings:

Original Equipment Cost: RM50,000 (credit to remove from books).

Accumulated Depreciation: RM30,000 (debit to remove accumulated depreciation).

Book Value (Net Carrying Amount): RM20,000 (50,000 – 30,000).

Cash Received: RM25,000 (debit).

Gain on Disposal: RM5,000 (credit, since 25,000 – 20,000 = 5,000).

Journal Entry:

RM | RM | |

Cash received on disposal | 25,000 | |

Accumulated Depreciation | 30,000 | |

Equipment | 50,000 | |

Gain on Disposal | 5,000 |

Asset sold below book value

Assumptions: Same equipment, book value RM20,000.

Cash proceeds RM15,000 this time (loss of RM5,000).

Workings:

Original Equipment Cost: RM50,000 (credit to remove from books).

Accumulated Depreciation: RM30,000 (debit to remove accumulated depreciation).

Book Value (Net Carrying Amount): RM20,000 (50,000 – 30,000).

Cash Received: RM15,000 (debit).

Loss on Disposal: RM5,000 (debit, since 15,000 – 20,000 = -5,000).

Journal Entry:

RM | RM | |

Cash received on disposal | 15,000 | |

Accumulated Depreciation | 30,000 | |

Loss on Disposal | 5,000 | |

Equipment | 50,000 |

Tips: Gain or loss on disposal will be recorded under “Other Income” or “Other Expenses” in the Statement of Profit or Loss.

6. Period-End Adjustments

- Depreciation and amortisation must be recorded consistently each accounting period.

- Ensure asset records are updated for new purchases, disposals, and impairments.

How Assets Affect Business Performance

Assets are not just numbers on a balance sheet, they directly shape efficiency, financing, and long-term growth.

Six key dimensions of performance where assets play a direct role:

Liquidity & Working Capital

- Explains how current assets (cash, receivables, inventory) affect short-term financial health and ability to meet obligations.

Profitability & Efficiency Ratios

- Shows how assets are measured in performance metrics (ROA, asset turnover) to evaluate profitability and efficiency.

Financing & Borrowing Power

- Highlights how assets are used as collateral and reviewed by lenders/investors when assessing creditworthiness.

Strategic Planning & Capital Budgeting

- Demonstrates how asset tracking influences future planning, replacements, and investment decisions.

Risk Management & Business Continuity

- Relates to how assets like insurance, backup equipment, or intangible assets (brand) protect the business from risk.

Business Valuation & Exit Strategy

- Connects assets to long-term goals such as company valuation, sale, or merger negotiations.

Common Mistakes in Asset Accounting

Even small oversights in asset accounting can create major compliance risks and distort financial reporting.

Capitalising low-value or short-term expenses

- Everyday items like office supplies or small repairs should be expensed, not recorded as assets. Misclassifying them inflates the balance sheet and understates expenses.

Ignoring impairment or failing to depreciate assets accurately

- Assets lose value over time. If depreciation or impairment reviews are missed, reported profits may look higher than reality, leading to misleading results.

Not updating asset registers during disposal or upgrade

- When old equipment is sold, scrapped, or replaced, failing to update records leaves “ghost assets” on the books. This can cause reporting errors and confuse lenders or auditors.

Mixing personal and business asset usage

- Using personal assets for business (or vice versa) without proper records blurs ownership. This is a common issue in SMEs and complicates tax compliance.

Overlooking intangible assets

- Many businesses track tangible items carefully but ignore intangibles like software, trademarks, or goodwill. Missing these under-reports business value.

Inconsistent valuation methods

- Switching between cost, fair value, or revaluation without clear policy creates unreliable financial statements and may breach accounting standards.

Conclusion: Why Assets Matter in Accounting and Business

Understanding what qualifies as an asset, how to classify it, and how to record it properly is foundational for any business. From operational planning to strategic financing, asset accounting shapes both compliance and confidence.

If your business is seeking to strengthen financial credibility, attract investors, or improve public visibility, partnering with a specialised PR agency can help position your brand as trustworthy and growth-ready. Clear financial reporting paired with strong media presence builds both market confidence and stakeholder trust.

Disclaimer: The information in this article is provided for general informational purposes and reflects IFRS/MFRS concepts at the time of writing. It is not accounting, tax, legal, or investment advice and should not be relied upon as a substitute for professional judgment. Always consult a licensed accountant or advisor regarding your specific needs.

Frequently Asked Questions about Assets

What qualifies as an asset in accounting?

An asset is a resource controlled by a business expected to provide future benefits, including cash, equipment, property, and intellectual property.

How do you record an asset in a journal entry?

Use double-entry accounting: debit the asset account, credit the payment source (cash, payables).

Why are assets depreciated?

Depreciation spreads the cost of tangible assets over their useful life, reflecting usage and reducing taxable income.

Are all expenses considered assets?

No. Only costs that bring future economic benefit are capitalised as assets; others are treated as expenses.

What is the difference between tangible and intangible assets?

Tangible assets have physical form (e.g. machinery), while intangible ones (e.g. patents) provide value without physical presence.

How do assets affect business valuation?

Accurate and up-to-date asset values improve transparency, affect financing terms, and play a key role in valuation during sales or investments.