Key Takeaways

- Financial accounting ensures legal compliance, transparency, and investor readiness in 2025.

- Key reports include the balance sheet, income statement, and cash flow statement.

- Tools like SQL, AutoCount, and Xero simplify monthly closings and audit prep.

- Accurate records support SST submissions, LHDN filings, and business loan approvals.

- SMEs can start with basic reporting templates and scale up to cloud accounting tools.

Table of Contents

ToggleFinancial accounting tracks the financial position of your business and ensures compliance with Malaysia’s tax and reporting laws. For SMEs, it’s the foundation for audit readiness, cash flow management, and smarter decision-making for stakeholders.

In 2025, more businesses are moving to cloud-based systems, but many still rely on outdated spreadsheets. This blog breaks down what financial accounting involves, why it still matters, and what tools SMEs in Malaysia should consider.

What Is Financial Accounting and How Does It Work?

It involves recording, summarising, and reporting business transactions to show financial health.

Financial accounting follows standardised principles in Malaysia. Companies apply MFRS (Malaysian Financial Reporting Standards) issued by MASB (Malaysia Accounting Standards Board) or MPERS for private entities.

Fun fact: MFRS is based on IFRS (International Financial Reporting Standards)

It records business activities (revenue, expenses, assets, liabilities) and presents them through formal reports. These reports are used by external stakeholders like auditors, tax authorities, lenders, and investors.

Key objectives:

- Maintain accurate records for compliance

- Present a true and fair view of financial health

- Ensure audit and tax readiness

Why Is Financial Accounting Still Critical for Malaysian SMEs in 2025?

It’s the baseline for compliance, investor trust, and financial transparency.

Despite the rise of digital tools, many SMEs still struggle with accounting gaps. Missing documentation, late filings, or misclassified expenses can lead to penalties or failed audits. Financial accounting helps:

- Submit timely tax returns to LHDN (such as Form C, CP204, CP204A and other)

- Meet SST reporting obligations

- Comply with the Companies Act 2016 (keep proper accounting records and file required returns)

- Prepare for grants or business loan applications

- Build trust with shareholders and partners

Deadlines to remember for companies: Submit CP204 (tax estimate) 30 days before the basis period begins, Form C within 7 months after financial year end, CP204A revisions in the 6th/9th/11th month.

What Are the Core Financial Reports Every Business Should Prepare?

The balance sheet, income statement, and cash flow statement are essential. Together, these three reports give you a complete picture of your business’s financial health and performance.

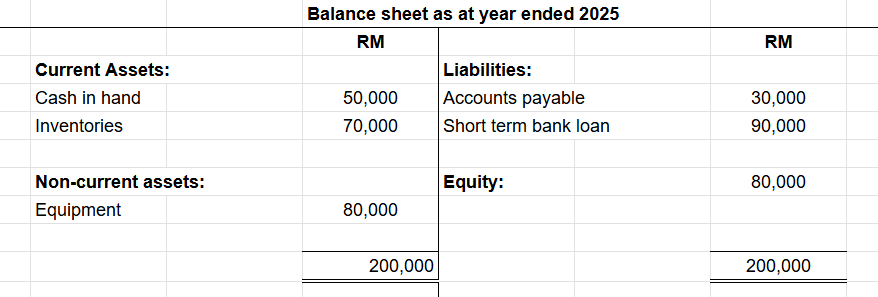

1. Balance Sheet

Shows assets, liabilities, and equity at a point in time.

Example:

Total Assets: RM 200,000 (cash RM 50,000, inventory RM 70,000, equipment RM 80,000)

Total Liabilities: RM 120,000 (bank loan RM 90,000, accounts payable RM 30,000)

Equity: RM 80,000

This confirms that accounting equation: Assets = Liabilities + Equity

Tip: Items in the balance sheet are listed from most liquid to least liquid.

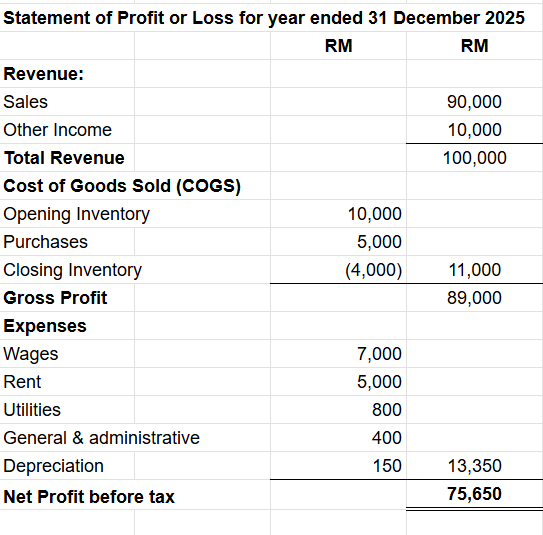

2. Income Statement (Profit & Loss)

Reports revenue, expenses, and profit/loss over a period.

Formula: Net Profit = Revenue – Expenses

Example:

This shows the profitability of your operations during the period.

3. Cash Flow Statement

Tracks cash inflows and outflows from three activities:

- Operations (daily business)

- Investing (asset purchase/sale)

- Financing (loans, equity injections)

Example:

- Cash from operations: +RM 35,000

- Cash used in asset purchase: –RM 10,000

- Loan repayment: –RM 5,000

- Net cash increase: RM 20,000

Even if profit is high, a negative cash flow signals liquidity risk.

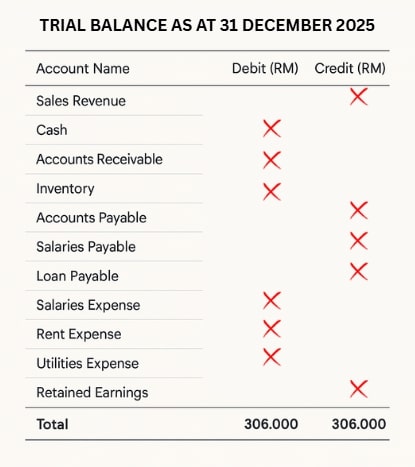

4. Trial Balance

The trial balance is a summary of all your ledger accounts. It acts as a check to make sure your total debits equal your total credits, helping you confirm that your books are balanced and tally.

Example:

Both Debits and Credits should have a total RM306,000, checking that they tally is a crucial step to confirm there are no errors in your accounting records.

5. General Ledger

The master record that categorises transactions by account (sales, rent, utilities, loans). It feeds into all other reports.

Tip: These reports should be prepared monthly, not just annually, to ensure ongoing financial control.

What Tools Help SMEs Manage Financial Accounting Efficiently?

Popular options include SQL Accounting, AutoCount, QuickBooks, and Xero.

Tool | Best For | Key Features | Local Support |

SQL Accounting | Local SMEs, trading, logistics | Inventory control, SST, multi-location support | Yes |

AutoCount | Retailers, wholesalers | POS integration, real-time reports, SST | Yes |

QuickBooks Online | Freelancers, service businesses | Cloud access, multi-device use, invoicing | No (mostly online) |

Xero | Remote teams, digital-first firms | Bank feeds, recurring bills, dashboard | No (partner-based) |

These accounting tools and software automate journal entries, tax calculations, and reconciliation, freeing up SMEs business owners to focus on operations.

How Does Financial Accounting Support Tax and SST Compliance?

It ensures data integrity for submissions to LHDN and Customs.

LHDN audits, SST checks, and company secretary filings all rely on the accuracy of your books. Financial accounting helps:

- Track deductible and non-deductible expenses

- Generate audit trails for SST input/output tax

- Calculate real profit vs cash profit

- Prevent double entries or mismatched balances

Proper financial accounting helps SMEs avoid overpaying or underclaiming taxes, which often happens due to a lack of accurate documentation.

What Are the First Steps for SMEs New to Financial Accounting?

Start with structured templates, basic bookkeeping software, and a monthly closing checklist.

If you’re just starting out:

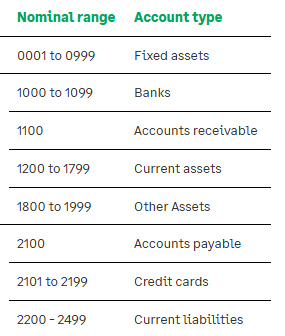

- Use Excel/Google Sheets to create three tabs for P&L, balance sheet, and ledger

- Track income and expenses using a simple category-based system (map every transaction to an account code)

Example:

- Create a simple month-end closing repeatable checklist (bank recon, invoice matching, SST log)

- Gradually adopt software once your volume grows. (100 to 200 transaction per month)

- Minimal internal controls (even with a tiny team): Segregation of duties (lightweight): one person preps payments, another approves.

- First metrics to watch monthly

- Gross Margin %:Are pricing/COGS under control?

- Operating Margin %: Are overheads creeping?

- Cash Conversion Cycle: Days Inventory + Days A/R − Days A/P

- A/R >30 days: Which debtors need chasing?

- Runway: how many months you can keep operating before cash hits zero, at your current pace. Calculating method is cash on hand divide by average monthly net burn (cash outflow minus cash inflow).

Quick month-end closing checklist: Ready to use

[ ] Post all sales invoices & supplier bills

[ ] Record payroll, EPF/SOCSO/EIS, and related accruals

[ ] Accrued utilities/interest where bills not received

[ ] Bank reconciliation (all accounts)

[ ] A/R (Receivables) aging vs control account agrees

[ ] A/P (Payables) aging vs control account agrees

[ ] Inventory count & adjustments (if applicable)

[ ] Fixed assets: add disposals/additions, post depreciation

[ ] SST/e-invoice log updated, file all tax docs

[ ] Review P&L, Balance Sheet

[ ] Lock editing access for posted month and back up GL + documents

Conclusion: Financial Accounting Is Still the Backbone of Every SMEs

In 2025, SMEs that maintain accurate, timely financial accounts will unlock better funding, lower compliance risk, and clearer growth decisions. Financial accounting isn’t a back-office chore, it’s a strategic asset.

Start simple. Stay consistent. Upgrade tools as you grow.

This blog post was brought to you by Press, a leading PR agency in Malaysia dedicated to helping businesses amplify their success stories.

Disclaimer: This article is for general information only and is not accounting, tax, legal, or investment advice. Malaysian rules (LHDN/SSM/SST) change frequently and may affect you differently. Always consult a licensed Malaysian accountant or tax adviser before acting.

Frequently Asked Questions about Financial Accounting

What is the difference between financial and management accounting?

Financial accounting focuses on external reporting, management accounting is for internal decisions.

Is financial accounting mandatory in Malaysia?

Yes. Companies must keep proper accounting records under the Companies Act 2016. Sole proprietors and partnerships aren’t under the Act but must keep adequate records for LHDN tax purposes.

Can I do financial accounting without hiring an accountant?

Yes, with proper tools and discipline. But as complexity grows, professional help is recommended.

How often should financial reports be prepared?

At minimum quarterly, ideally monthly. Year-end reports are mandatory for submission.

Which software is best for Malaysian SMEs?

SQL and AutoCount offer strong local support, QuickBooks and Xero are better for cloud-first users.

What is SST and how does it relate to accounting?

SST is Sales and Service Tax. Accurate financial records are needed to calculate SST payable and claimable.